The Fair Housing Project of Legal Aid of North Carolina is pleased to announce free basic and advanced virtual fair housing trainings, in partnership with the North Carolina Housing Finance …

News

Fair Housing Project releases updated State of Fair Housing report

Discrimination based on race and disability continued to account for the vast majority of housing discrimination complaints filed in North Carolina in 2020, according to the latest edition of State …

HUD Awards Legal Aid NC $500,000 to Continue Its Fair Housing Work

On September 2, the U.S. Department of Housing and Urban Development (HUD) announced that Legal Aid of North Carolina’s Fair Housing Project has been awarded two grants, totaling $500,000, to …

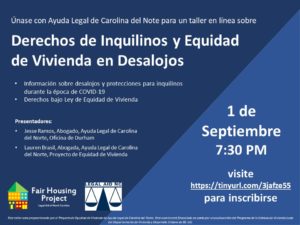

Tenant Rights & Fair Housing in Evictions Webinar in Spanish – Taller en Español Sobre Derechos de Inquilinos y Equidad de Vivienda en Desalojos

[English Below] Únase con Ayuda Legal de Carolina del Norte para un taller en línea sobre derechos de inquilinos y equidad de vivienda en desalojos el 1 de Septiembre de …

Fair Housing Project Releases Report: 2020 State of Fair Housing in North Carolina

Discrimination based on race and disability continue to account for the vast majority of housing discrimination complaints filed in North Carolina, according to a new report by the Fair Housing …

Fair Housing Webinar in Spanish – Taller en Español Sobre Discriminación en las Viviendas

[English Below] Únase con el Proyecto de Equidad de Vivienda de Ayuda Legal de Carolina del Norte y el Departamento de Relaciones de la Comunidad de Charlotte-Mecklenburg para un taller …

Register Now: Free Online Fair Housing Conference on April 23, 2021

Registration is now open for the annual Fair Housing Conference sponsored by the Fair Housing Project of Legal Aid of North Carolina and the City of Raleigh’s Fair Housing Hearing …

Free Webinar: Fair Housing Rights of People with Disabilities

Join Legal Aid of North Carolina and the Greensboro Housing Coalition for a free online webinar about fair housing and the rights of people with disabilities, including reasonable accommodations and …

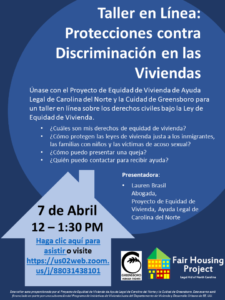

Fair Housing Webinar in Spanish – Taller en Español Sobre Discriminación en las Viviendas

[English Below] Únase con el Proyecto de Equidad de Vivienda de Ayuda Legal de Carolina del Norte y la Cuidad de Greensboro para un taller en línea sobre la Ley …

Housing complex settles discrimination case, adopts fair criminal history policy for tenant applicants

RALEIGH, March 29, 2021 – Legal Aid of North Carolina announced today that it has settled a housing discrimination complaint against Cypress Grove Apartments, a multifamily housing complex located in …